All Categories

Featured

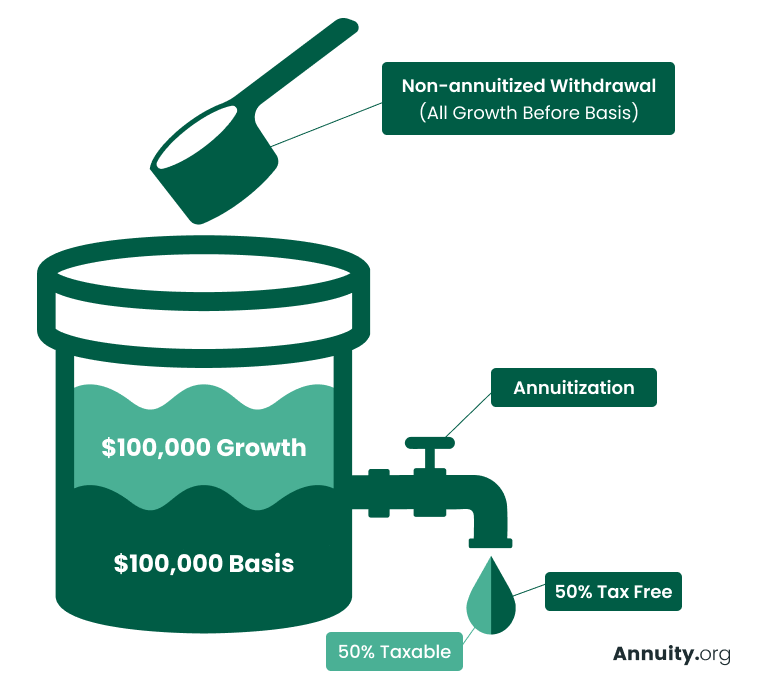

The very best option for any person need to be based upon their present scenarios, tax obligation situation, and economic goals. Deferred annuities. The money from an inherited annuity can be paid out as a solitary round figure, which becomes taxable in the year it is received - Variable annuities. The disadvantage to this alternative is that the profits in the contract are distributed initially, which are strained as common income

The tax-free principal is not paid out till after the profits are paid out.: The beneficiary can request that the profits be annuitizedturning the money right into a stream of earnings for a lifetime or a collection amount of time. The benefit is the repayments are only partly tired on the interest portion, which indicates you can delay taxes well right into the future.:

Likewise described as the Life Span or 1 Year Rule, the nonqualified stretch option utilizes the recipients remaining life span to compute a yearly called for minimal circulation. The following year, the staying amount of money is divided by 29, and so forth. If there are numerous beneficiaries, every one can utilize their very own life expectations to determine minimum distributions. With the stretch option, recipients are not limited to taking the minimum circulation (Single premium annuities). They can take as much as they want as much as the whole remaining resources. If you do not have a prompt need for the money from an inherited annuity, you might select to roll it into one more annuity you regulate. Through a 1035 exchange, you can guide the life insurer to transfer the cash money from your inherited annuity into a new annuity you establish. That way, you remain to postpone tax obligations up until you access the funds, either with withdrawals or annuitization. If the acquired annuity was initially developed inside an IRA, you could exchange it for a certified annuity inside your own individual retirement account. Inheriting an annuity can be a monetary boon. However, without thoughtful consideration for tax obligation

ramifications, maybe a breast. While it's not possible to completely stay clear of taxes on an acquired annuity, there are several ways to reduce existing tax obligations while maximizing tax deferment and enhancing the long-term worth of the annuity. You should not presume that any kind of discussion or info consisted of in this blog offers as the invoice of, or as a substitute for, customized financial investment suggestions from DWM. To the degree that a viewers has any type of concerns relating to the applicability of any type of details concern discussed above to his/her individual scenario, he/she is encouraged to seek advice from with the expert expert of his/her deciding on. Shawn Plummer, CRPC Retirement Coordinator and Insurance Coverage Agent: This individual or entity is initially in line to receive the annuity death advantage. Calling a main recipient helps avoid the probate process, permitting a quicker and more direct transfer of assets.: Must the main beneficiary predecease the annuity owner, the contingent beneficiary will certainly receive the advantages.: This option permits recipients to get the entire continuing to be worth of the annuity in a single repayment. It provides prompt access to funds but may lead to a significant tax obligation problem.: Recipients can choose to obtain the death advantagesas proceeded annuity repayments. This alternative can provide a steady earnings stream and may help expand the tax obligation liability over numerous years.: Unsure which fatality advantage option supplies the best economic outcome.: Anxious concerning the prospective tax implications for recipients. Our team has 15 years of experience as an insurance policy agency, annuity broker, and retirement organizer. We understand the anxiety and uncertainty you really feel and are dedicated to aiding you discover the most effective option at the least expensive expenses. Display adjustments in tax regulations and annuity regulations. Keep your strategy updated for continuous tranquility of mind.: Customized suggestions for your one-of-a-kind situation.: Thorough testimonial of your annuity and beneficiary options.: Reduce tax obligation liabilities for your beneficiaries.: Continuous surveillance and updates to your plan. By not working with us, you risk your recipients dealing with substantial tax concerns and financial problems. You'll feel great and assured, recognizing your beneficiaries are well-protected. Get in touch with us today completely free suggestions or a cost-free annuity quote with enhanced survivor benefit. Get annuity survivor benefit help from a qualified economic professional. This solution is. If the annuitant dies before the payment period, their recipient will receive the quantity paid into the strategy or the money value

Taxes on inherited Guaranteed Annuities payouts

whichever is higher. If the annuitant dies after the annuity begin day, the beneficiary will normally proceed to obtain payments. The response to this inquiry depends on the kind of annuity youhave. If you have a life annuity, your repayments will finish when you pass away. If you have a particular annuity term, your repayments will certainly continue for the defined number of years, also if you die before that period ends. It depends on your annuity and what will occur to it when you die. Yes, an annuity can be passed on to successors. Some rules and regulations have to be complied with to do so. Initially, you will need to name a recipient for your annuity. This can be done when you first purchase the annuity or after that. No, annuities normally stay clear of probate and are not part of an estate. After you die, your beneficiaries need to contact the annuity company to start obtaining repayments. The company will certainly after that normally send the payments within a couple of weeks. Your beneficiaries will certainly get a swelling sum payment if you have actually a postponed annuity. There is no set period for a recipient to assert an annuity.

Annuity recipients can be contested under certain circumstances, such as disputes over the legitimacy of the recipient classification or cases of excessive influence. An annuity fatality advantage pays out a set quantity to your recipients when you die. Joint and beneficiary annuities are the 2 kinds of annuities that can stay clear of probate.

Latest Posts

Understanding Fixed Annuity Vs Variable Annuity Everything You Need to Know About Financial Strategies Breaking Down the Basics of Variable Annuity Vs Fixed Indexed Annuity Features of Tax Benefits Of

Decoding Choosing Between Fixed Annuity And Variable Annuity A Closer Look at Retirement Income Fixed Vs Variable Annuity What Is Tax Benefits Of Fixed Vs Variable Annuities? Advantages and Disadvanta

Breaking Down Variable Vs Fixed Annuities A Comprehensive Guide to Deferred Annuity Vs Variable Annuity What Is Immediate Fixed Annuity Vs Variable Annuity? Benefits of Choosing the Right Financial Pl

More

Latest Posts